Partnered Projects

Mirado Project

Status

About Mirado

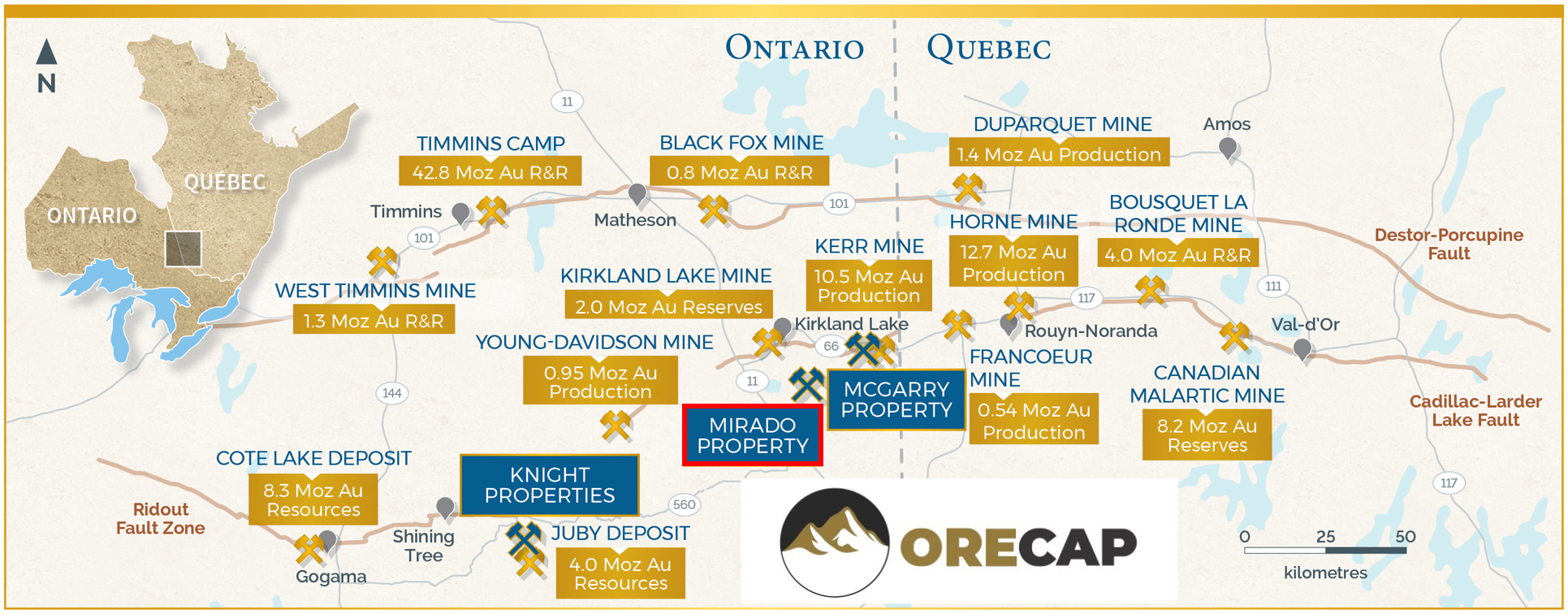

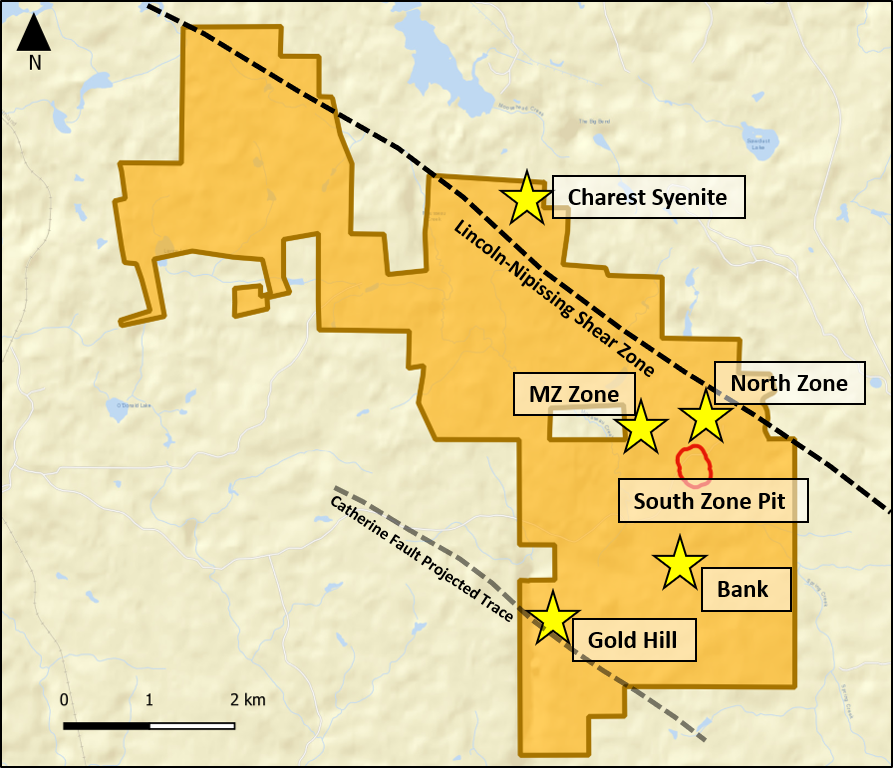

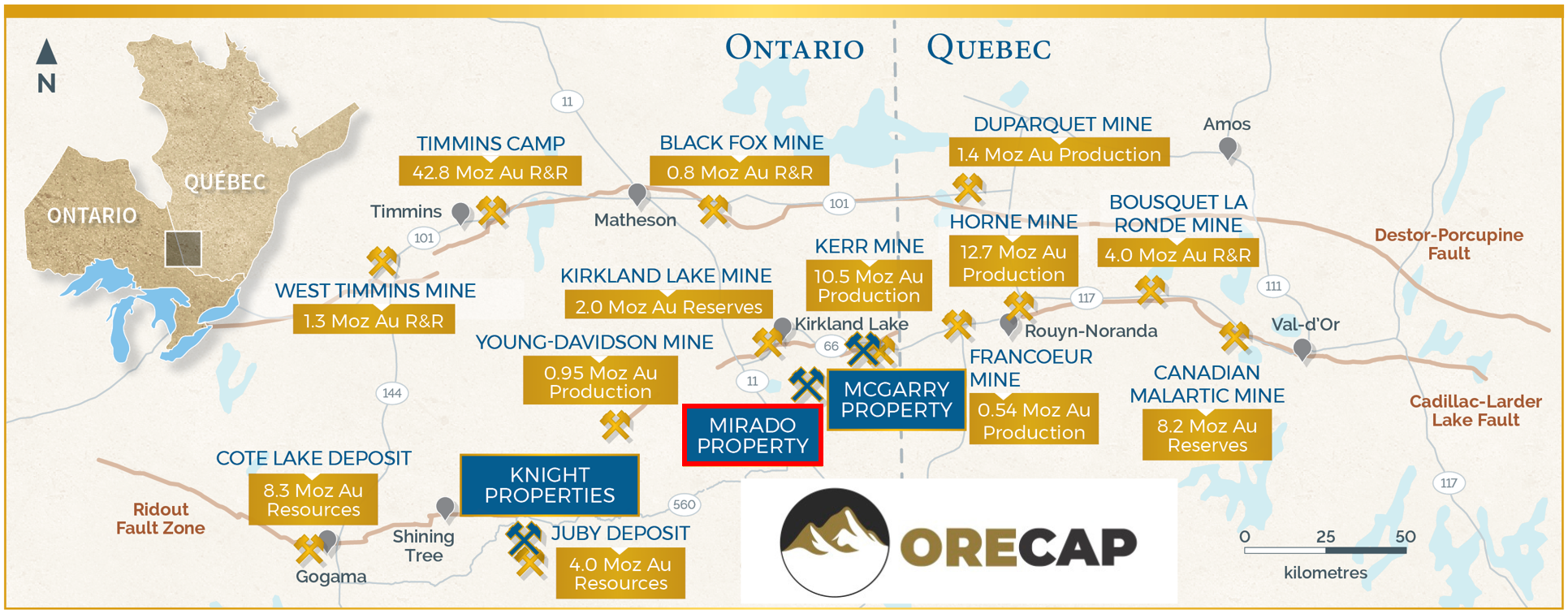

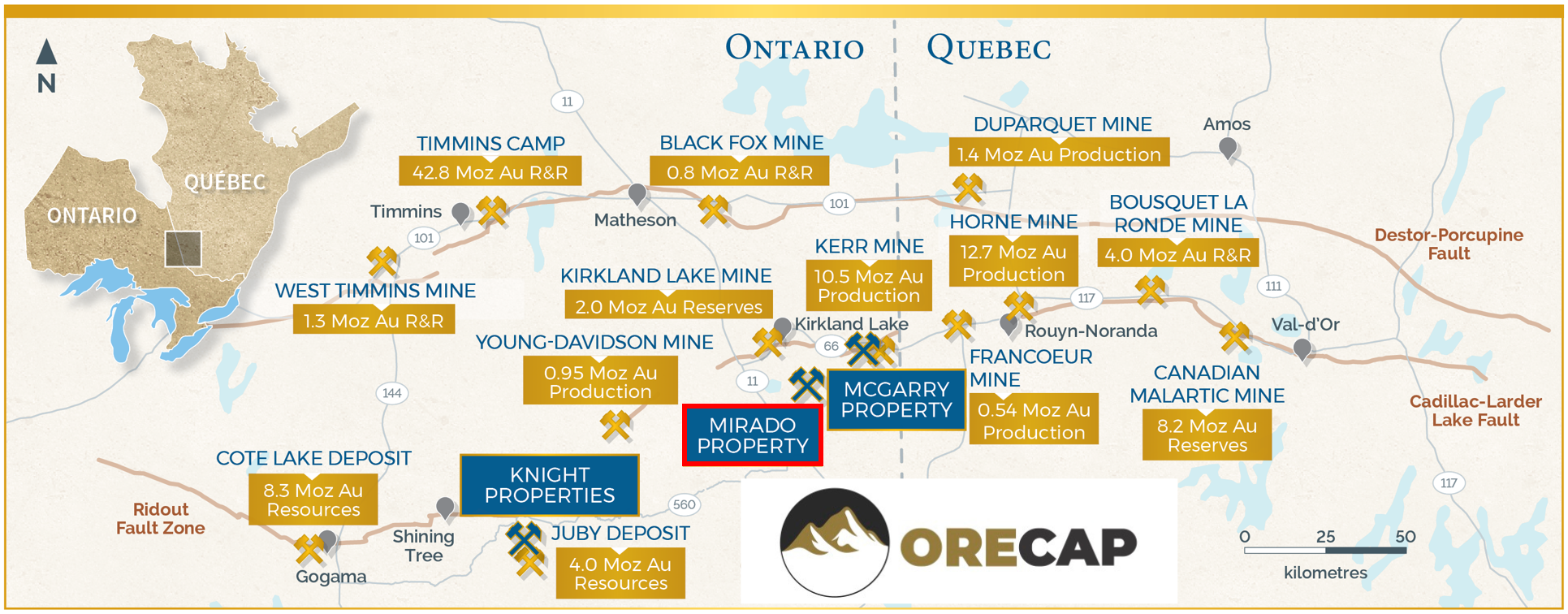

Mirado Mine is a past producing underground gold mine located 35km SE of Kirkland Lake, and is easily accessible via road. Mirado is proximal to numerous operations including Macassa, Young-Davidson, Holt, Black Fox, and Westwood. Mirado deposit interpreted to be a gold rich VMS system with a gold-rich stringer footwall (South Zone) overlain by a zinc and gold-rich bedded hanging wall (North Zone).

History of Mirado

Gold on the Mirado Gold Property was first discovered in the early 1920s and later mined by underground methods to a depth of 500′ in the 1940s. Several exploration programs, diamond drilling campaigns, and underground and open pit mining activities have taken place since then. Over the years, over 40,000m of drilling was completed by several companies, including Mirado Nickel Mines, Broulan Reef, Amax Minerals Exploration, and Golden Shield Resources Inc (Golden Shield).

The previous work can be reviewed in historic reports on the Ontario government website, including an environmental base line study, bulk sampling, stockpiling of open pit and underground material, and metallurgical test-work programs. Golden Shield contracted Dynatec Mining Ltd. in 1986 for underground and open-pit operations. Much of the Mirado south zone was pre-stripped, and an open pit was mined to a depth of 30m. The material removed from the pit was stockpiled on the Mirado property, where it remains today.

Metallurgical test-work was undertaken under the supervision of A. S. Hayden of EH Associates in 1986. Settling and filtration tests were conducted, and Lakefield Research prepared test slurries. A study of three alternative metallurgical processes was undertaken, including (1) selective flotation with cyanidation of concentrate; (2) direct cyanidation of ore with Merrill- Crowe recovery; and (3) direct cyanidation of ore, with carbon in pulp gold recovery. Gold recoveries up to 95% were realized.

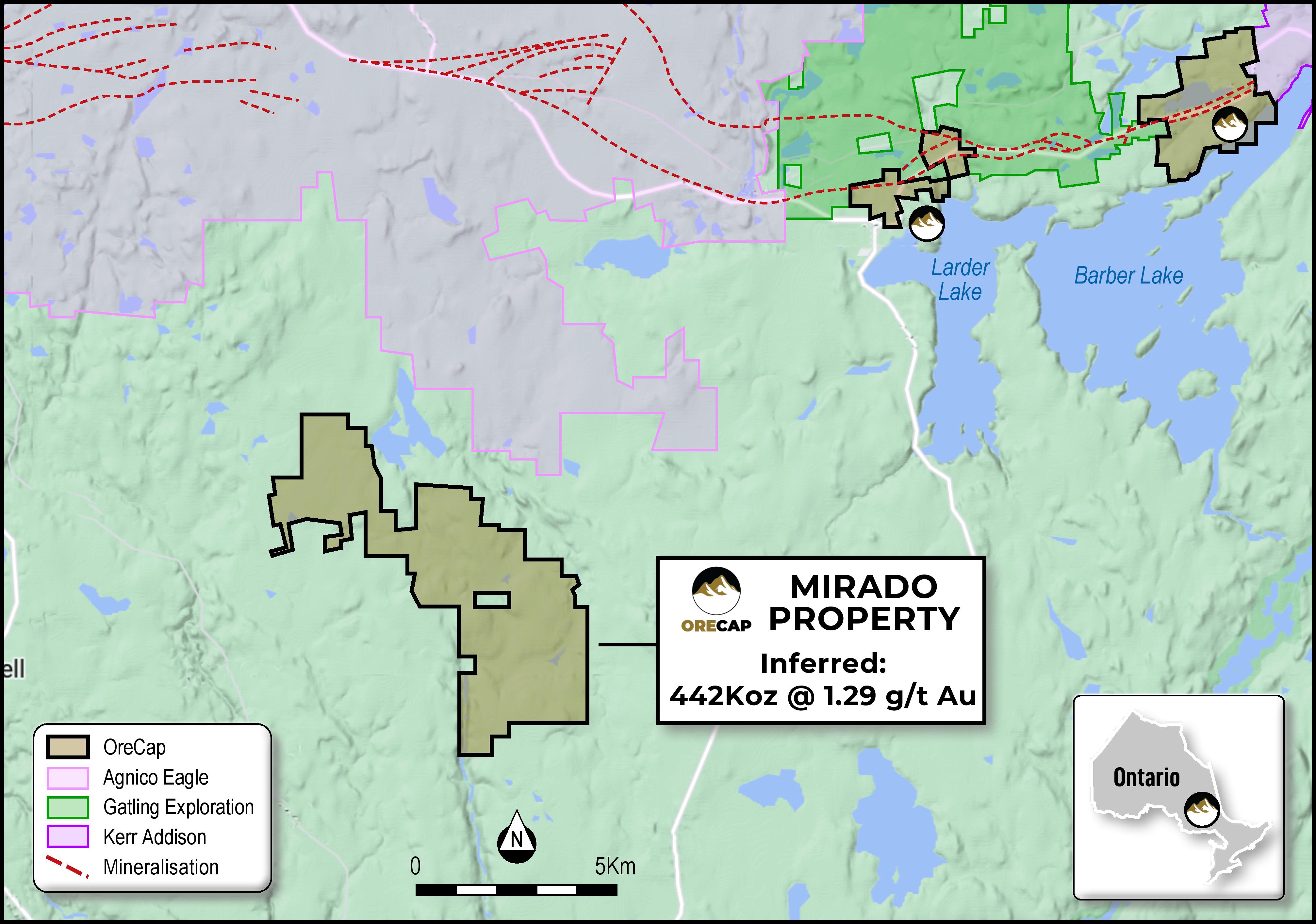

The Mirado gold project is located 35 km southeast of the gold mining town of Kirkland Lake in northeastern Ontario. The entire Mirado property encompasses 5,800 acres. The focus of the Mirado Gold Project consists of 12 contiguous patented claims, with surface and mining rights, owned 100% by Orefinders.

Surrounding the core patented claims, ORECAP has optioned and/or staked 37 additional contiguous claims covering approximately 10 km of prospective strike length. Amongst these claims is ORECAP's 100% owned MZ property, which forms the Mirado Mine's western extension in-pit resource.

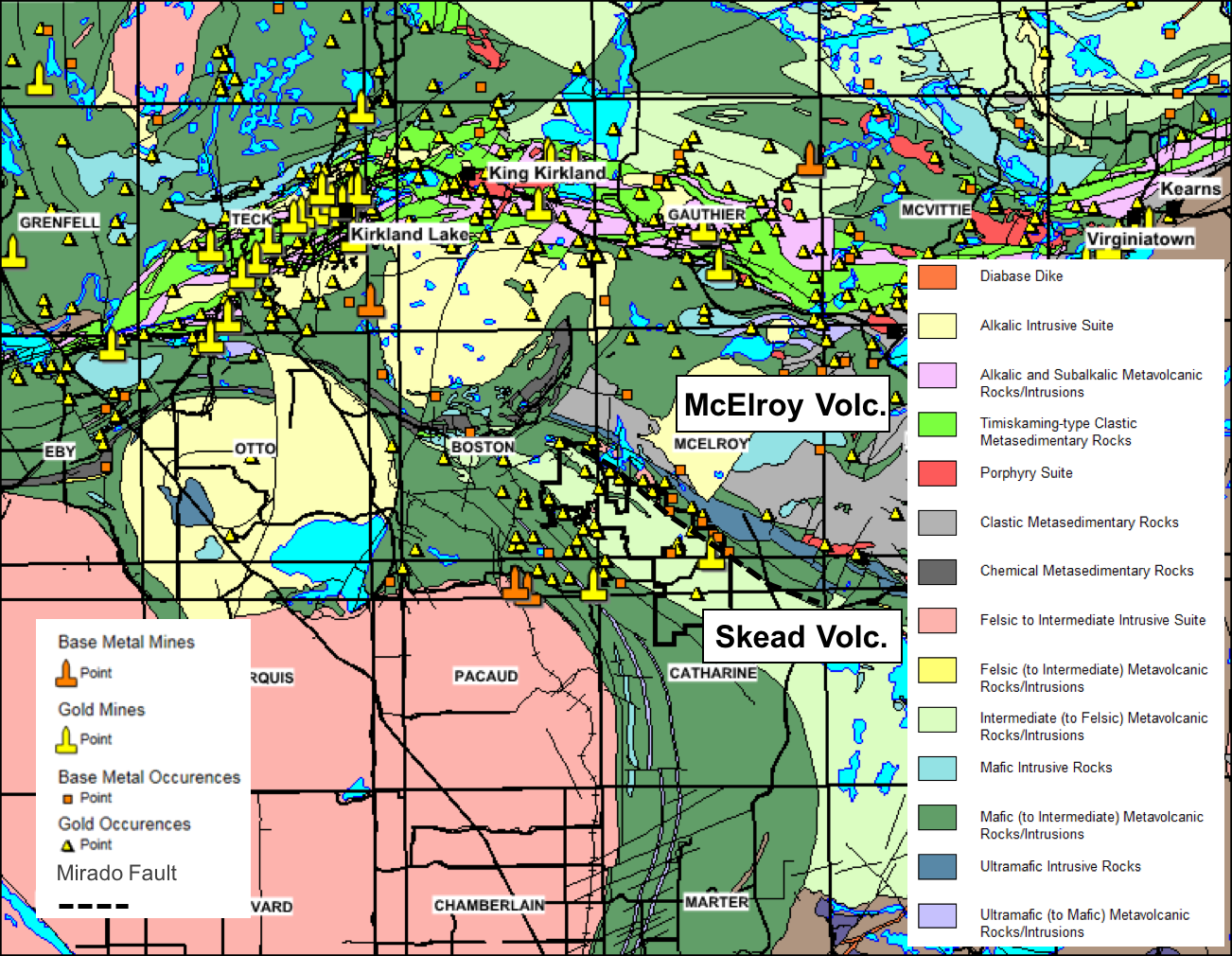

The Mirado gold project is situated within the Abitibi Gold District, which has historically produced more than 200 million ounces of gold over the past century, with more than 100 million ounces of gold in current reserves. The prolific Kirkland Lake mining camp is located in eastern Ontario close to the Quebec border and has historically produced 50 million ounces of gold. Much of the historical Kirkland Lake gold production has taken place along or near a major regional geological fault structure known as the Larder Lake-Cadillac Fault (LLCF).

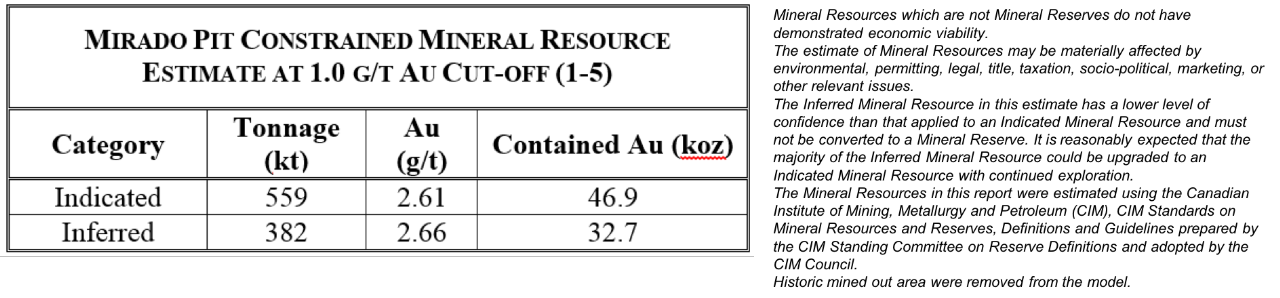

Mineral Resources

The Project is considered economically viable with the current Mineral Resource Estimate of 559,000 tonnes at an average grade of 2.61 g/t gold for 46,900 ounces of Indicated Mineral Resource and additional Inferred Mineral Resource of 382,000 tonnes at an average grade of 2.66 g/t gold for 32,700 ounces, based on a cut-off grade of 1.0 g/t gold.

The regional geological map above indicates the Mirado property's location in relation to the major gold deposits located along or near the LLCF. Mirado property is favourably located near the top of an Achaean intermediate to felsic, fragmental calc-alkaline volcanic sequence known as the Skead Assemblage. Gold mineralization is structurally controlled and has been identified along NW-SE trending shear zones. North-South brittle structures have also been recognized on the property as being favourable for gold mineralization. A regional northwest-trending fault defines the upper contact of the Skead Assemblage. This faulted contact is situated on the northern half of the property.

Numerous other zones of interest beyond the scope of PEA:

North Zone (MNZ): high priority drill target situated in a very favourable geological environment where a sizeable gold and polymetallic deposit can be developed.

South Zone at Depth (MSZD) and MZ Zone: High-value drill targets identified from trenching at MZ (21.8 g/t Gold over 4.80 metres).

Gold Hill: grab sampling identified vein system at the surface—100m along strike and returned up to 26.8 g/t Gold; veins are open at depth and along strike.

Bank: Discovery on the surface with narrow high-grade polymetallic vein traced for over 30 metres in length, averaging 4.8 g/t Gold up to 80 cm wide.

Charest Syenite and Nipissing Shear Zone: intrusion with gold-rich quartz veins—grab samples returned 14.8 g/t, 10.6 g/t and 1.98 g/t Gold; syenite intrusive bodies are well known in the Abitibi to host large gold deposits. Nipissing shear contact is highly deformed, altered and mineralized over a 6km strike.

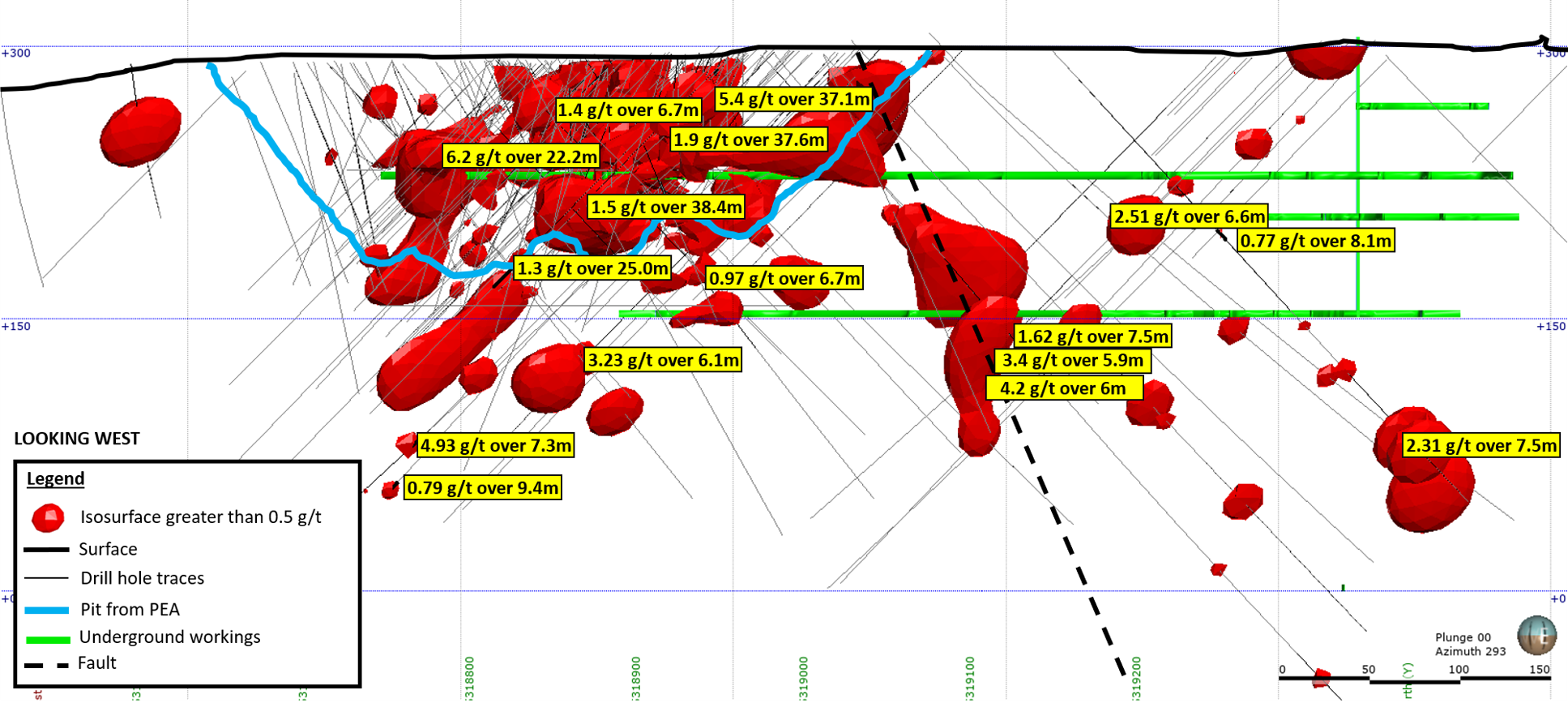

3D Fly-By Video of Mirado Orebody

Technical Reports

Technical Reports

In January 2018, ORECAP announced its Preliminary Economic Assessment for the South Zone Open Pit part of the Mirado Gold Mine, located to the southeast of Kirkland Lake, Ontario. Further details available on our news release of January 15, 2018.

This PEA considers the only production from a specific area, encompassing approximately five percent of ORECAPS's Mirado Project. The Mineral Resource contemplated within this PEA for mining is within the South Zone's open pit. It is near surface mineralization that can be economically mined within a relatively short time frame and without using an on-site processing or tailings facility. The Company intends to use the free cash flow from this operation to develop what it sees as the true upside potential on the broader Mirado Project and other assets it owns.

This PEA's economics indicates an after-tax internal rate of return ("IRR") for the Project of 158% and a pre-tax undiscounted Net Present Value ("NPV") of $30.8 million and a $20.5 million after-tax NPV at a 5% discount rate. Payback on capital is reported at seven months. The average gold price used is US$1,300 per ounce and an exchange rate of 1.00 USD =0.76 CAD.

The initial preproduction expenditure is estimated at $2.4 million to achieve the first production from the open pit. The project life is three years, after approximately six months of open-pit pre-stripping. The Life of Mine ("LOM") cash operating cost is US$941 per ounce of gold, and the LOM all-in sustaining cost is US$969 per ounce of gold.

Mirado Project Presentation

McGarry Project

Status

Project Summary

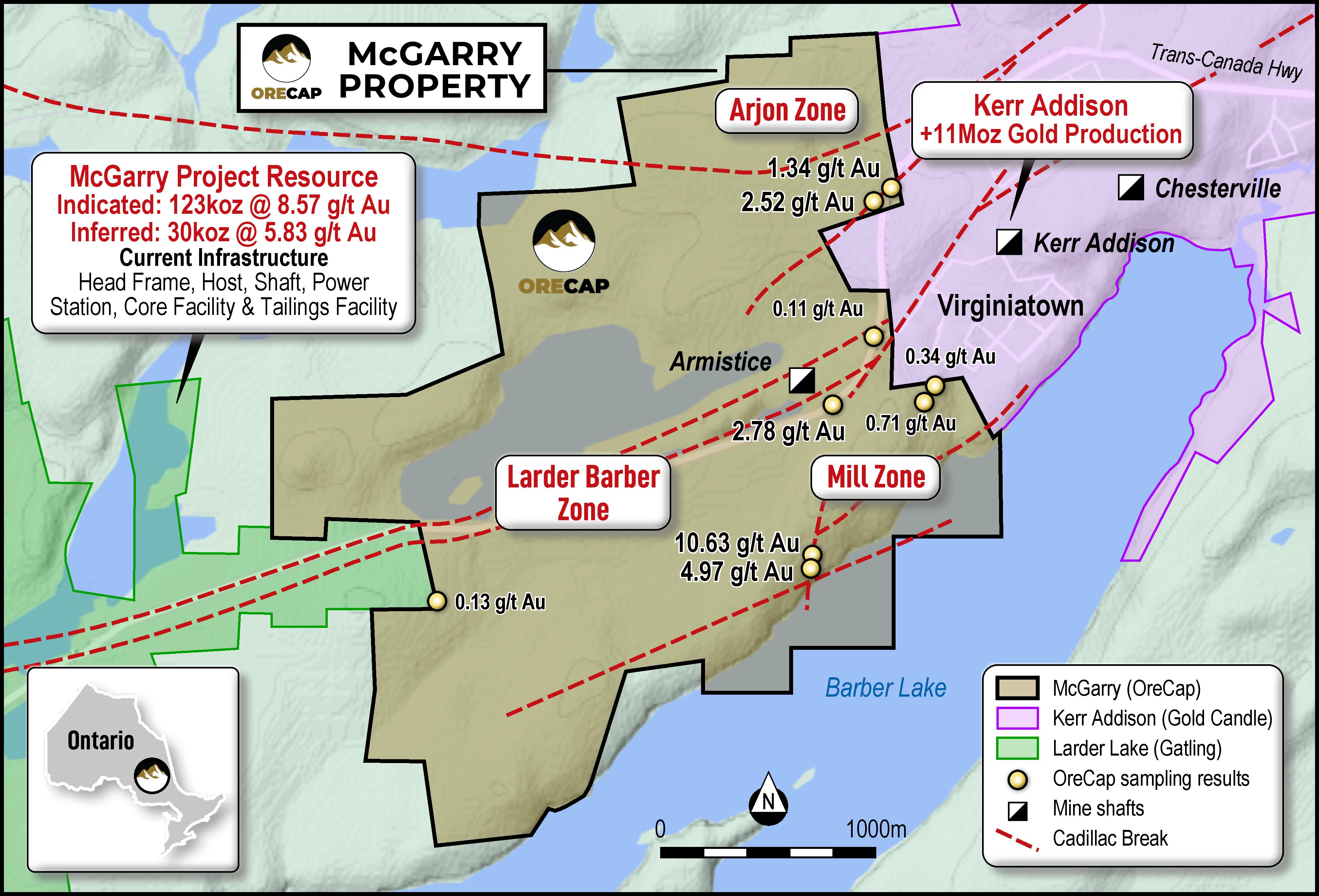

The McGarry property is in Virginiatown, Ontario, within the Abitibi Greenstone Belt and spans 2.4km on one of the world's most prolific gold structures, the Cadillac Larder-Lake Break. The Property encompasses 681 hectares and is comprised of 46 Patented Mining Claims and 5 Mining Licenses.

McGarry hosts a NI43-101 indicated resource of 123,000 oz at an average grade of 7.7g/t gold (uncut or 112,000 ounces with grades top-cut to 51.4 gpt) an additional inferred resource of 30,000 oz. At an average grade of 5.3 g/t (uncut or 29,000 ounces with grades top-cut to 51.4 gpt) per McGarry resource estimate from 2009 (see cautionary note at the end). McGarry also has a NI 43-101 Preliminary Economic Assessment, published in 2011, based on McGarry's 2009 resource estimate.

Location and Infrastructure

McGarry is located east of and immediately adjacent to the Kerr-Addison Mine, one of Canada's largest gold mines producing over 12,000,000 ounces gold over 58 years ending in 1996 (Figure 1) (see MNDM OFR5831). Adjacent to the west of McGarry is Bonterra Resources' Cheminis Mine and Bear Lake deposit, which host a historic estimate* (2011, P+E Mining) of 3,750,000 tonnes at 5.7 g/t (683,000 oz) (inferred) and the Cheminis Deposit contains a historic estimate (2011, P+E Mining) of indicated of 335,000 tonnes at 4.1 g/t (43,800 oz) and inferred of 1,391,000 tonnes at 5.2 g/t (233,400 oz). Bonterra's Technical Reports are available at www.sedar.ca.

Onsite infrastructure includes a head frame, shaft compartments, hoist, offices, and fully functional core shack, all refurbished over the last ten years. McGarry is easily accessible with the Trans-Canada Highway running directly through the Property.

Mineral Resources

McGarry Historical Mineral Resource

The McGarry Property was the subject of a PEA study in 2011 that outlined a historical mineral resource of 447,000 tonnes grading 7.89 gpt gold for a total of 112,000 gold ounces in the Indicated Category and an additional 157,000 tonnes grading 5.83 gpt gold for a total of 29,000 ounces in the Inferred category (Table 1 below). This estimate was based on a 3.43 gpt Au lower cut-off with assay grades limited to 51.4 gpt gold. The specific gravity of 2.79 grams per cubic metres was used along with a minimum horizontal mining width of 1.5 metres. The report is available at www.sedar.ca under Kerr Mines Inc., and its amended version was published on 30 September 2011.

McGarry Historical Mineral Resource Estimate, Armistice Resources 2011 Technical Report

Refer below for the caution on historical mineral resources and mineral reserves.

As recently as 2013, the McGarry Mine was in production from significant underground workings and underwent underground exploration. Kerr/Armistice spent considerable capital upgrading the McGarry's infrastructure, including the shaft, hoist and onsite facilities necessary to mine underground. Additionally, extensive underground exploration yielded outstanding grades over very long lengths, including

325 N Zone – 2280 sublevel

- 8.2 g/t gold over 98m length and 1.5m width, Stope #1 (E & W)

- 4.6 g/t gold over 26m length and 1.3m width, Stope #1.5 (E & W)

- 7.6 g/t gold over 79.2m length and 1.4m width, Stope #2 (E & W)

325 N Zone – 2330 sublevel

- 11.1 g/t gold over 24m length and 1.7m width, Stope #1 (E)

- 6.1 g/t gold over 7.6m length and 1.2m width, Stope #2 (E)

- 4.3 g/t gold over 7.6m length and 1.8m width, Stope #2 (W)

440 N Zone – 2250 level

- 6.2 g/t gold over 18m length and 1.6m width

The above exploration results and grades include 35% dilution and are reported from Kerr Mines news release April 22, 2013 which is available on Sedar.com.

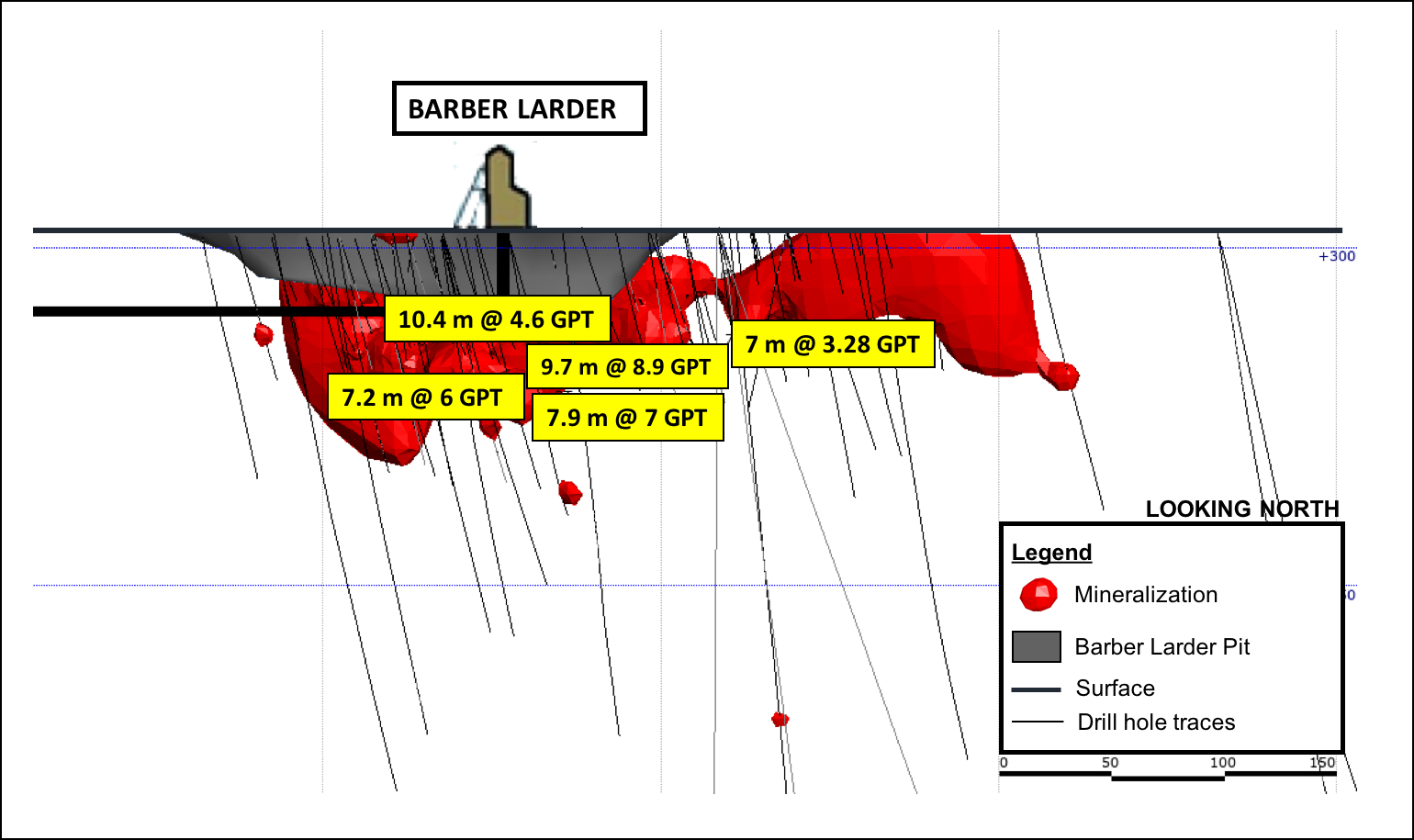

Barber-Larder Open Pit

The McGarry Property also hosts the Barber-Larder open pit that produced 70,000 tonnes of materials. Approximately 51,000 tonnes were processed at the Kerr Mill, which returned 6,700 ounces of gold for an average reconciled grade of 4.1 gpt gold (see MNDM AFRI file 32D04SE0006). This property area and its historical production are distinct from, although abutting, the McGarry shaft zone's production and resources.

Property Geology

The McGarry property straddles the Larder Lake Cadillac Deformation Zone (LLCDZ), which defines a major crustal structure separating rocks of different assemblages. To the south of the LLCDZ, rocks of the Larder Lake Group (Tisdale Assemblage) are overlain by and in fault contact with conglomerate, turbidites and shales of the Temiskaming Assemblage (<2674.3 ±3.7Ma) that have been folded into a southwest plunging syncline structure.

Within the LLCDZ, the same units as above are present but highly deformed and stretched out into bands parallel to the deformation zone. The Armistice deposit contains the same ore facies as found at the Kerr Addison, namely: Carbonate ore, which corresponds to deformed and altered ultramafic rocks, "flow" ore, which is a mylonitized tholeiitic volcanic, Graphite ore which corresponds to deformed, Iterflow graphitic sediment and the mineralized porphyry dykes.

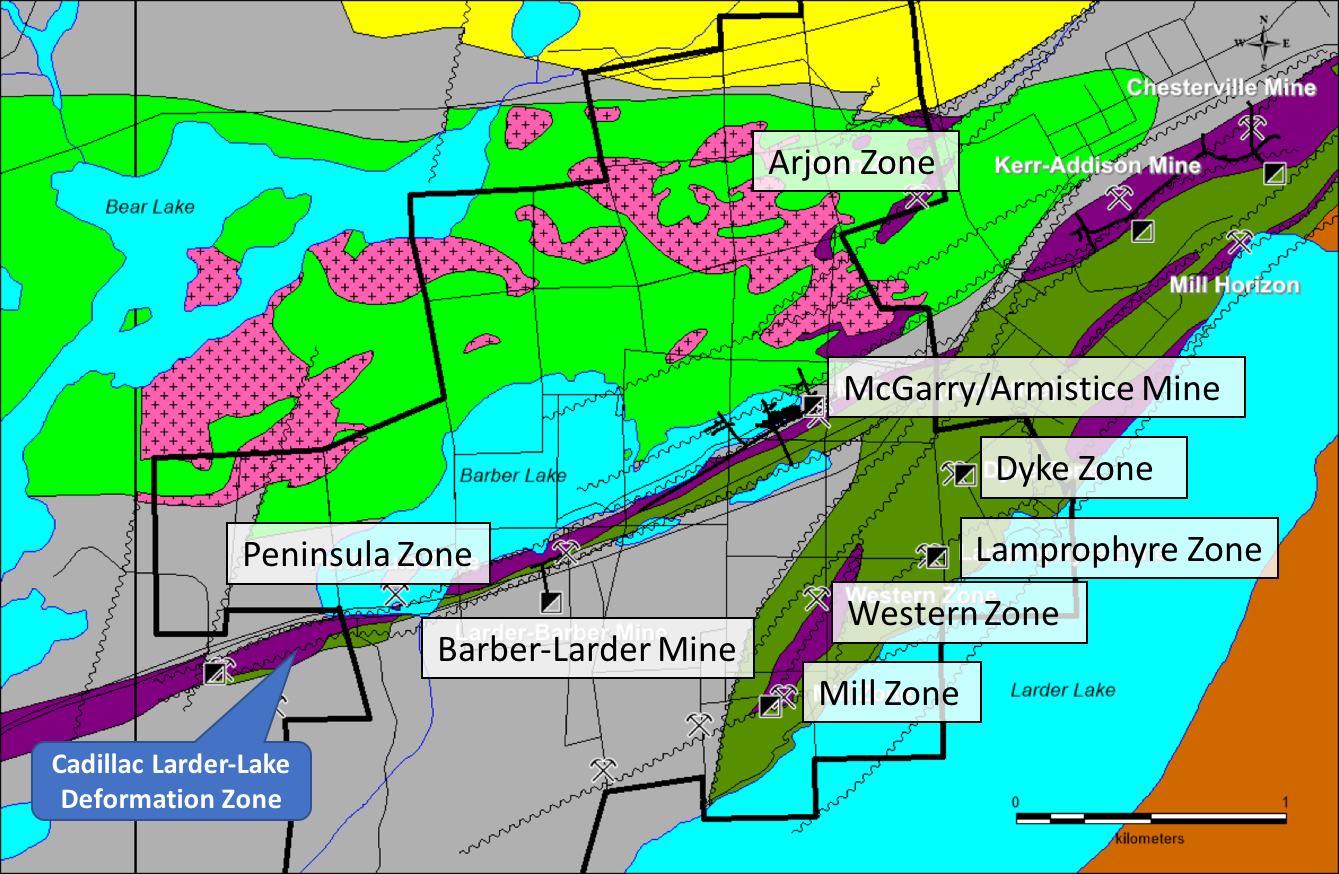

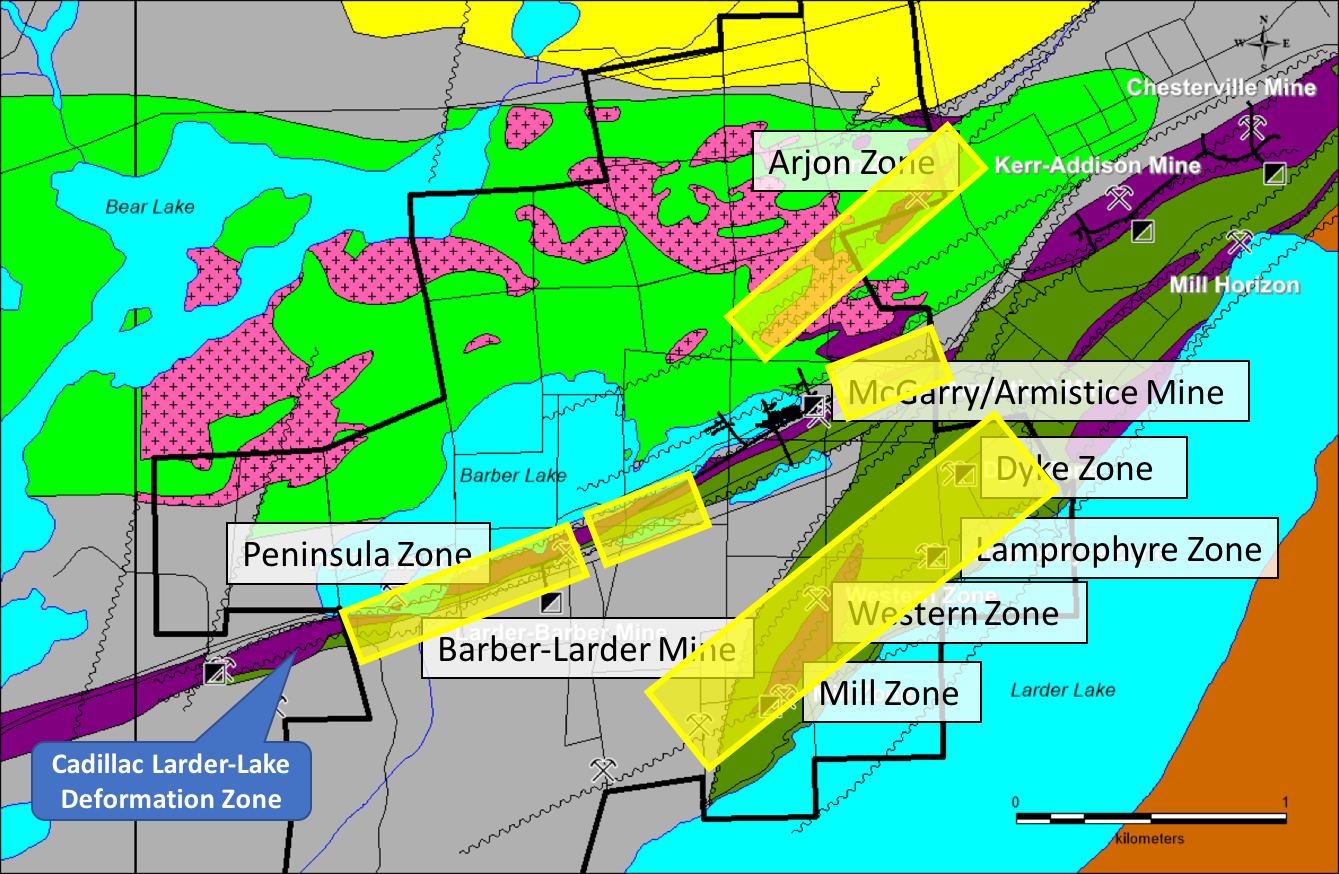

Maps and Sections

Exploration on the McGarry Project will focus on the main mineralized horizon along the Larder Lake Cadillac Deformation Zone (LLCDZ) on the one hand and evaluating the targets off to the north and south on secondary splays of the LLCDZ. The program will require a minimum of 5,000 metres to complete testing:

- Along the LLCDZ, the favourable horizon requires drill testing between the shaft and the Kerr Addison Property boundary to the east below 1,000 metres vertical and between the Larder Barber shaft and the western boundary of the Property. Also, the area between the Larder Barber shaft and the western drift on the 2,250-foot level requires more drilling.

- To the south of the LLCDZ is the Mill Zone and Lamprophyre Zone. They are located alongside a parallel structure to the LLCDZ and extends onto the Kerr Addison Mine property to the east.

- To the north of the LLCDZ, the Arjon Zone is located along a low-angle splay of the LLCDZ that extends to the northeast and intersects some ultramafic horizons in volcanics of uncertain age but possibly of Tisdale association. The structure is known to contain gold but has not been drilled since the 1940s and then only at very shallow depth.

3D Models

3D Fly-By Video of McGarry Shaft Zone

3D Fly-By Video of McGarry Shaft Zone

Technical Reports

Project Presentation

McGarry Exploration Potential

The McGarry Property is host to numerous gold mineralized zones, and many have only been drilled to a relatively shallow depth. The following is a summary of potential targets on the Property that merit follow-up (see Figure 2 for locations).

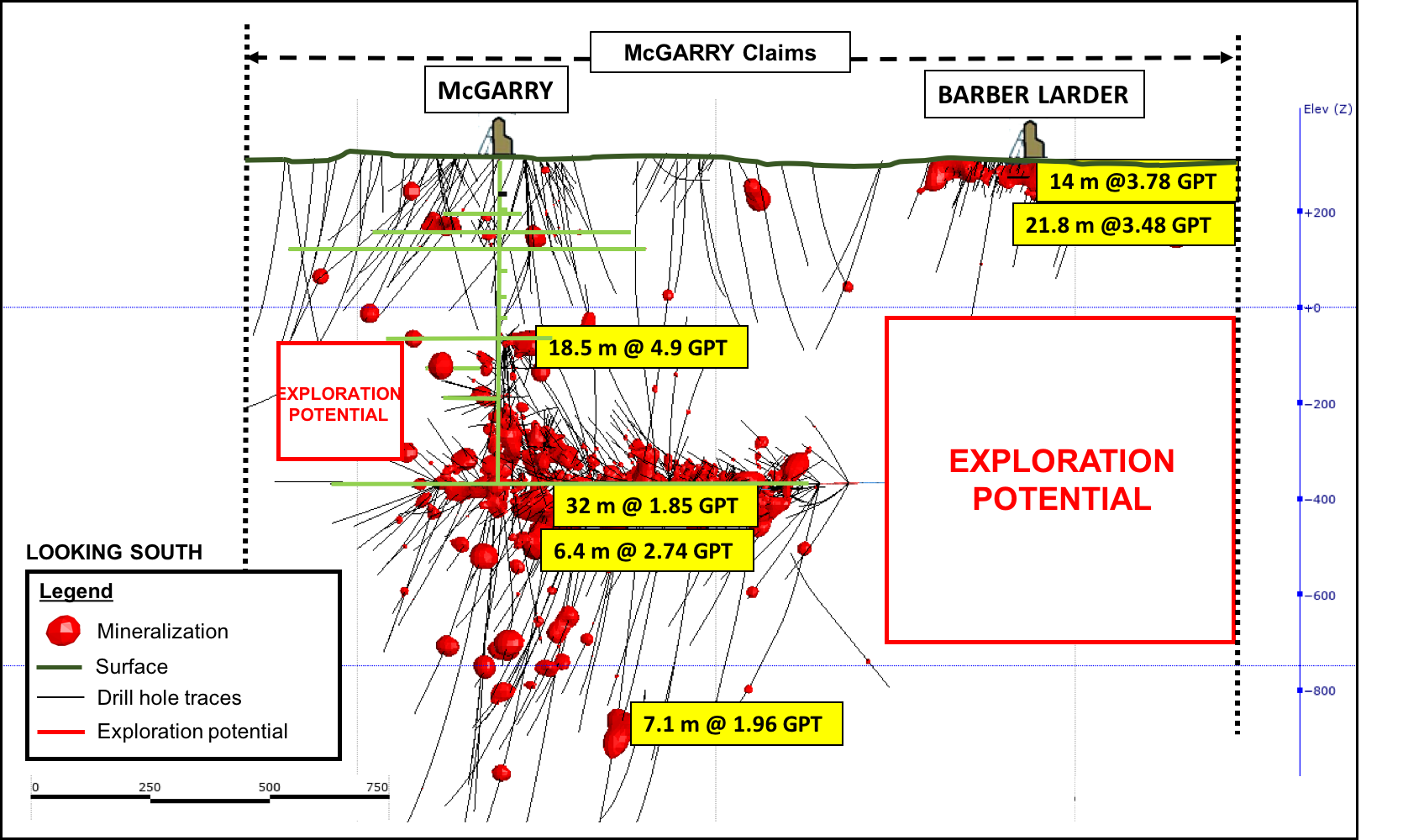

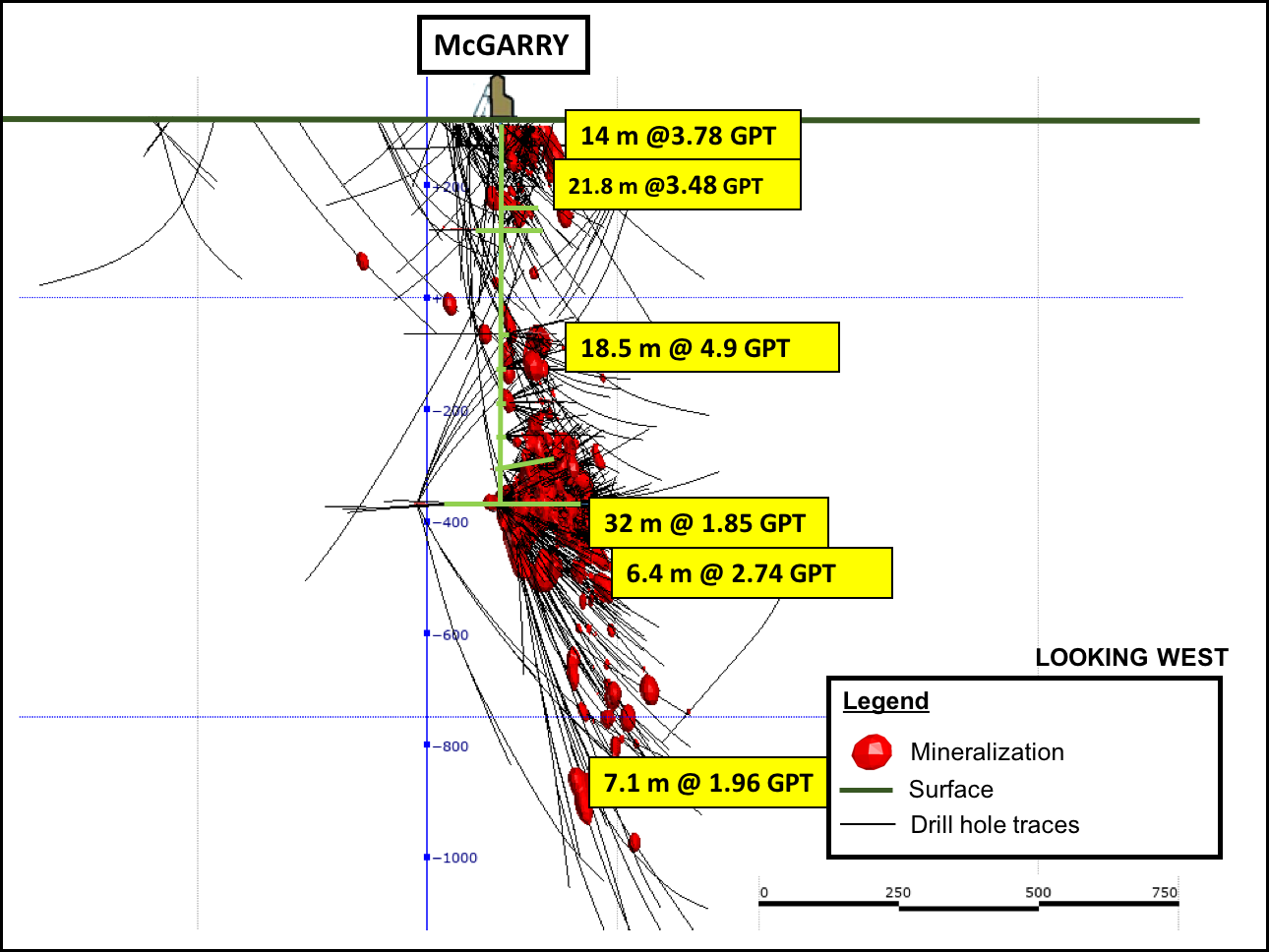

McGarry Mine

Development work by the previous owners has prepared the 325N Zone for production. This zone is of particular interest because of its high grades, as described above.

Exploration of the McGarry Deposit was quite extensive in and near the existing mining infrastructure. Generally, outside the shaft area between the 1,250 and 2,250 ft levels, exploration has been a lot less intensive. Considering the abundant underground infrastructure, the targets that can be pursued can be quite small. Between the shaft and the eastern limit of the Property, there is ample room for discovery. The proximity of the historic Kerr-Addison mine opens up the possibility of deep extensions of that deposit on the west side of the Armistice Fault, as suggested by north side down movement along the Larder Lake Break (see MNDM OFR5831).

Barber-Larder Extensions

The Barber-Larder deposit was mined as a small open-pit by Golden Shield Resources between November 1987 and July 1988. Production bottomed out at approximately 46 metres. However, the deposit continues below at similar grades (see MNDM, AFRI 32D04SE0006). Moreover, beyond the top 120 metres vertical, the deposit has not been much explored. There are indications of significant gold mineralization down to at least 600 metres vertical, where a hole intersected a narrow 30 cm core length interval of 11.7 gpt gold.

The previous exploration identified a number of targets that merit follow-up to the west of the Barber-Larder deposit. Approximately 150 metres grid-west of the shaft, a hole intersected 1.8 meters grading 3.4 gpt gold. Thirty metres grid-east of this, another hole intersected 3.9 gpt gold over 3.5 metres.

Twenty-five metres east of the open pit, a drill hole intersected a 7.9-metre interval grading 7.5 gpt gold. Although there are only 330 metres between the eastern end of the old workings in the Barber-Larder mine (120 metres) and the western end of the 2,250 foot level in the McGarry Mine, the vertical distance is over 550 metres. Within this envelope, there is ample room for exploration.

Peninsula Zone

The Peninsula Zone is located along with the same package of deformed and altered rocks immediately west of the Barber-Larder Mine. A hole drilled near the peninsular island returned 3.4 gpt gold over a core interval of 6.1 metres at a vertical depth of 85 metres (see MNDM AFRI 32D04SE0006).

Mill Zone and Western Zone

The Mill and Western Zones are located in a northeast striking ultramafic unit that has been completely altered to carbonate. The Mill Zone is located at the southern end of the 750m long ultramafic unit and is cut off by an east-northeast trending fault. Drilling on this zone intersected up to 36.7 gpt gold over 2.1 metres.

The Western Zone is located near the northeastern end of the same altered ultramafic unit. The zone was trenched over 75 metres in length and indicated the presence of a small mineralized shoot approximately 15 metres long and 1.7 metres wide and assaying an average of 3.9 gpt gold (see MNDM AFRI 32D04SE0402).

The Dyke Zone

The Dyke Zone is located in the McGarry Property's southeastern corner and is hosted by an altered diorite or gabbro. The NE trending dike is fractured in places and contains quartz and calcite stringers with pyrite. The zone extended for over 300 metres and was sampled over about 100 m giving an average of 7.25 gpt gold over about 1.0 metres in width (see MNDM AFRI 32D04SE0402).

Lamprophyre Zone

The Lamprophyre Zone is located on the southeastern corner of the Property and is hosted by mafic volcanics of the Temiskaming Assemblage. The mineralized zone consists of a NE trending shear at the contact of a lamprophyre dike. Values up to 3.9 gpt gold are reported over 0.9 metres (MNDM, ARV050).

Arjon Zone

The Arjon Shear Zone is located in the northeast corner of the McGarry Property and extends to the northeast onto the adjacent Kerr Property. A few drill holes marked on a 1941 map (MNDM ARV50, MDC03) and mapping indicate the presence of sheared ultramafics rocks transformed into green carbonate. The map also shows some NE trending quartz veins several tens of metres long but no assays. None of these drill holes were compiled by later explorers and are of uncertain origin. The Arjon Shear is oriented NE and cuts the Blake River mafic volcanics, some altered Ultramafic Units, and the syenite porphyry. Only low-grade gold values (up to 2.8 gpt Au) were found on the occurrence as there was generally no interest in the past for bulk-minable targets. Little work was done after the 1930s. There is a description of a "Northern" crosscut on the adjacent Kerr property driven on the 2,500 foot level across the Temiskaming sediments into some mafic volcanics, which are presumably the Blake River Assemblage. This reference describes a 400 foot (122 metres) section of drifting in altered and sheared volcanics that assayed a minimum of 200 ppb over the whole interval with some higher grade sections within.

This target needs to be followed-up for its potential for intrusion-hosted bulk-minable gold mineralization.

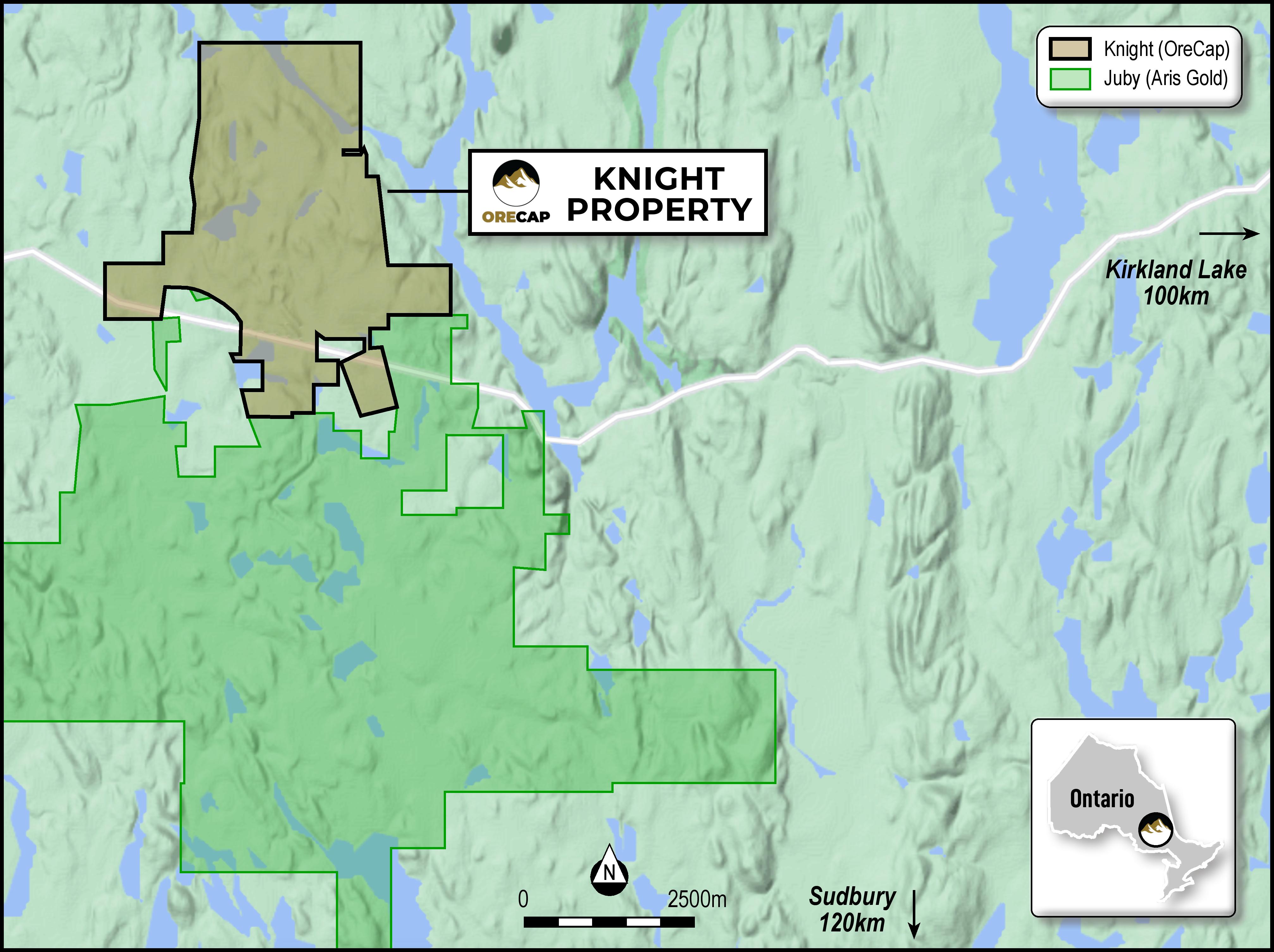

Knight Project

Status

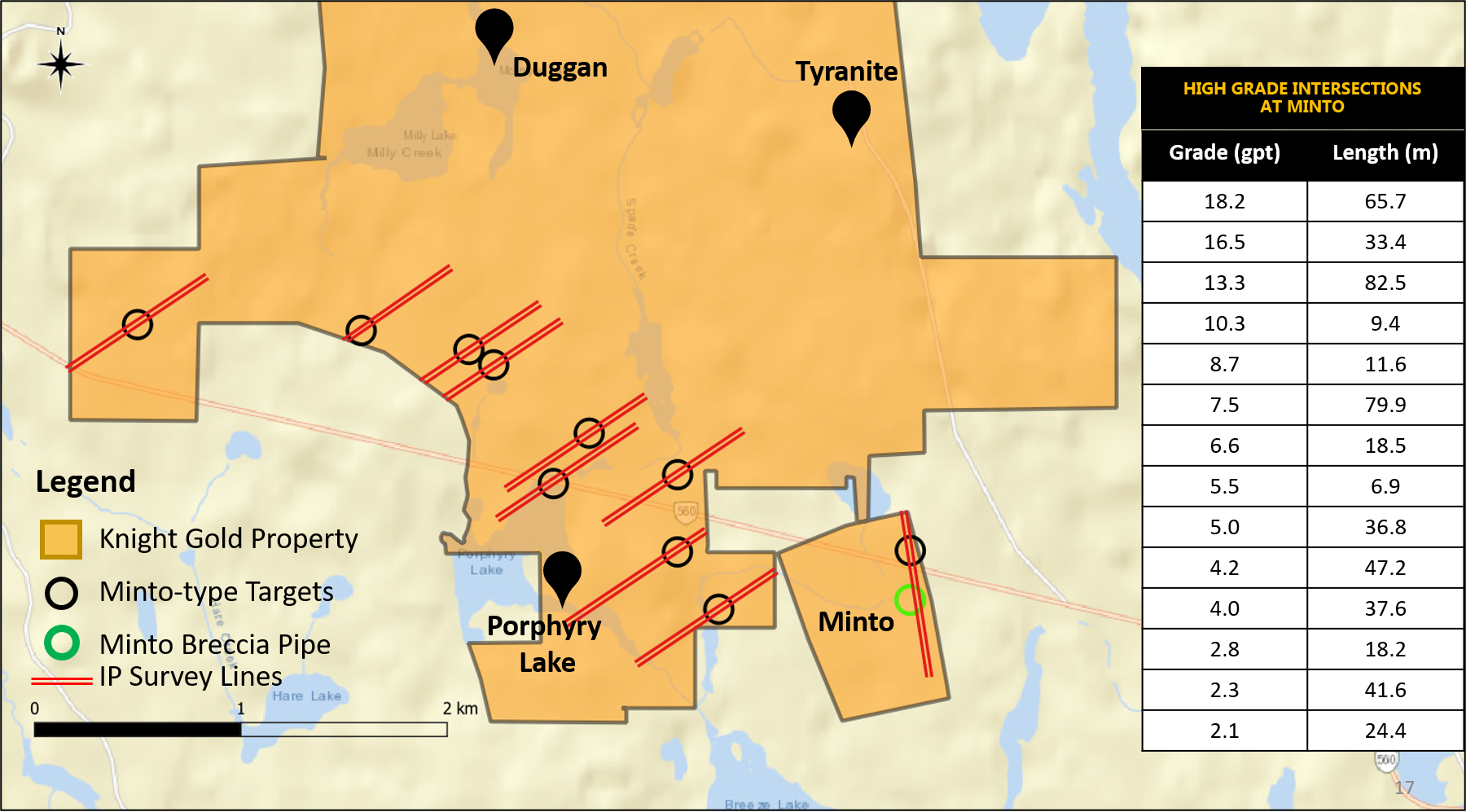

The Knight project is one of ORECAP’s flagship assets, located adjacent to Caldas Gold’s 2.3 million ounce Juby project, which is contiguous to the Knight property. The company has outlined three distinct targets on its Knight Gold Project, which it plans to drill in 2020 and 2021. Each target has a distinct geological style and have not been previously drill tested.

ORECAP's Knight Project is located along Highway 560 in the Knight and Tyrell townships of Ontario, approximately 80km east of Gogama and ~100km southwest of Kirkland Lake. The entire Knight Project land package encompasses ~2,200 ha and consists of 14 patented leases and 79 mining claims and is a consolidation of six proximate, high-potential properties with similar geology and significant drilling, exploration or development, including Tyranite, Tyranite Extension, Minto, Duggan, Porphyry Lake, Fawcett, and Corona.

Tyranite is a former producing mine with significant infrastructure in place.

Property Geology

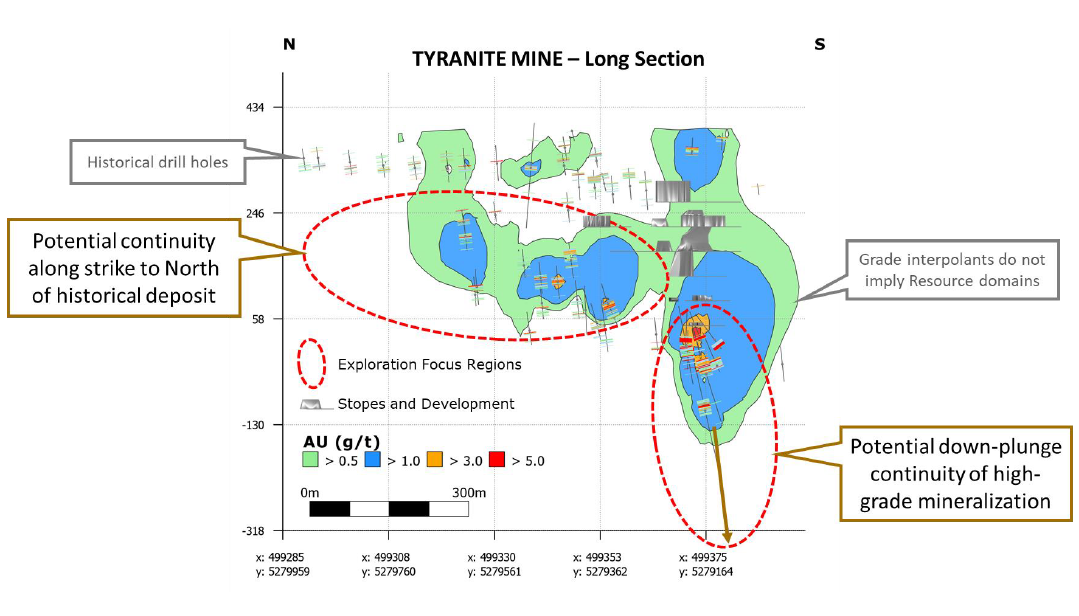

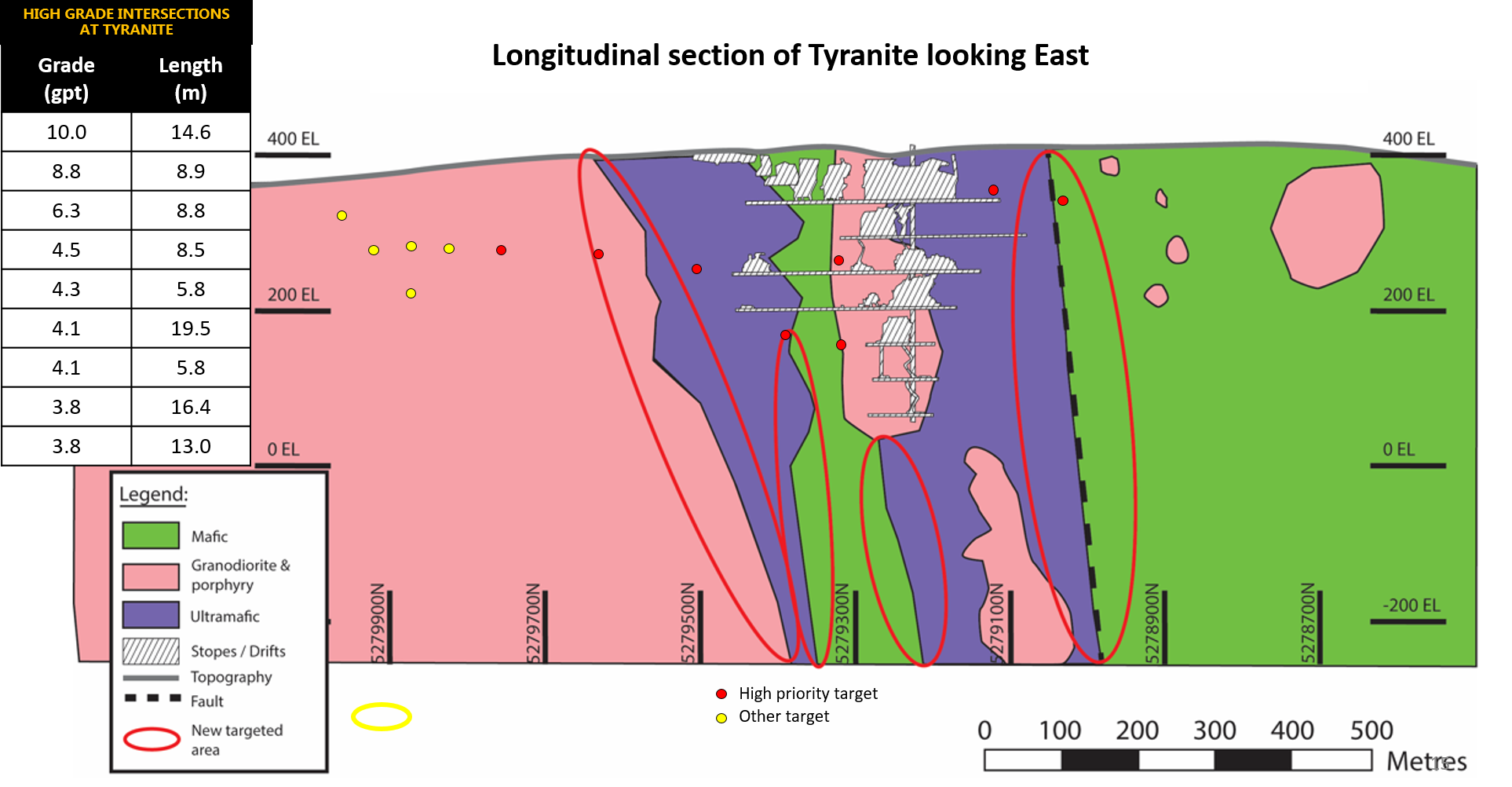

Tyranite

The structure is open to the south and at depth. There is a 5,000-metre drilling program targeting the expansion of high-grade zones.

New Interpretations at Tyranite

3D inversion of a high-resolution magnetic survey allowed us to redefine the geological model at Tyranite by focusing more on ultramafics' contact zones. Historically, Tyranite was mined as a 'fault' style deposit. ORECAP's interpretation focuses on the ultramafic units' contact zones striking at right angles to the fault. Tyranite has never been drilled using this specific model/interpretation.

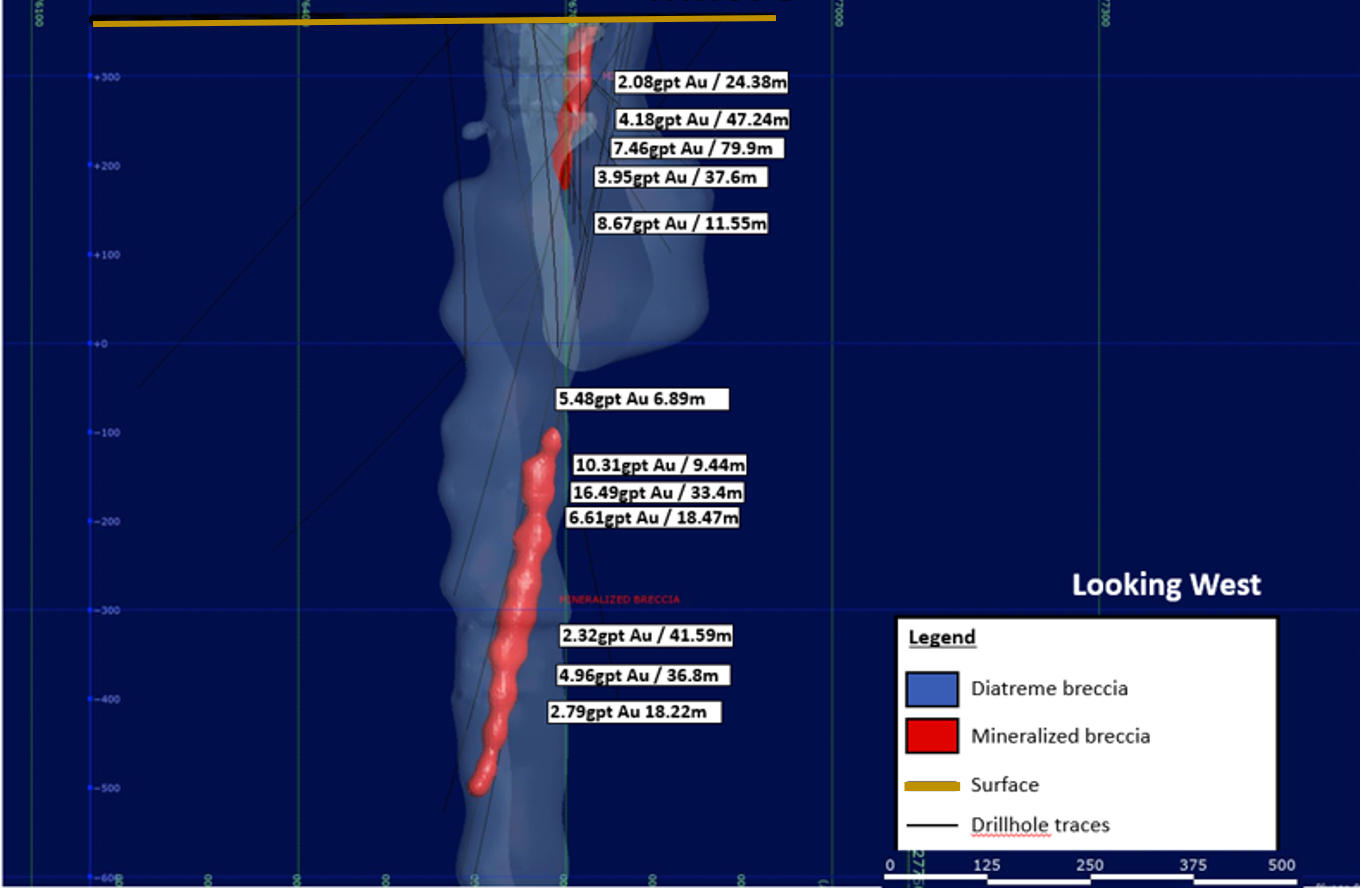

Minto

Minto is a high-grade breccia pipe, drilled from surface to over 800 metres depth. Minto's historical resource consists of a pod of carbonate sulphide breccias, with ~204,000 tonnes grading 0.2 oz/t (6.9 g/t) to a depth of 229 metres (750 ft). Refer to the note on historical resources on this page.

Notable Drill intersections at Minto include:

- 18.2 gpt Gold (7.9 gpt if cut to 31.1 gpt) over 65.7 metres and 4.61 gpt Gold (3.5 gpt if cut to 31.1 gpt) over 79.6 in drill hole MC-09-02

- 13.3 gpt Gold (11.0 gpt if cut to 31.1 gpt) over 82.5 metres in drill hole MC-09-01

- 1.15 gpt Gold over 280 metres, including 5.2 gpt Gold over 3.44 metres, 3.2 gpt Gold over 5.47 and 3.4 gpt Gold over 41 metres in drill hole MC-10-03b

- 1.01 gpt Gold over 192.0 metres, including 5.04 gpt Gold over 24.4 metres in drill hole MC-11-11

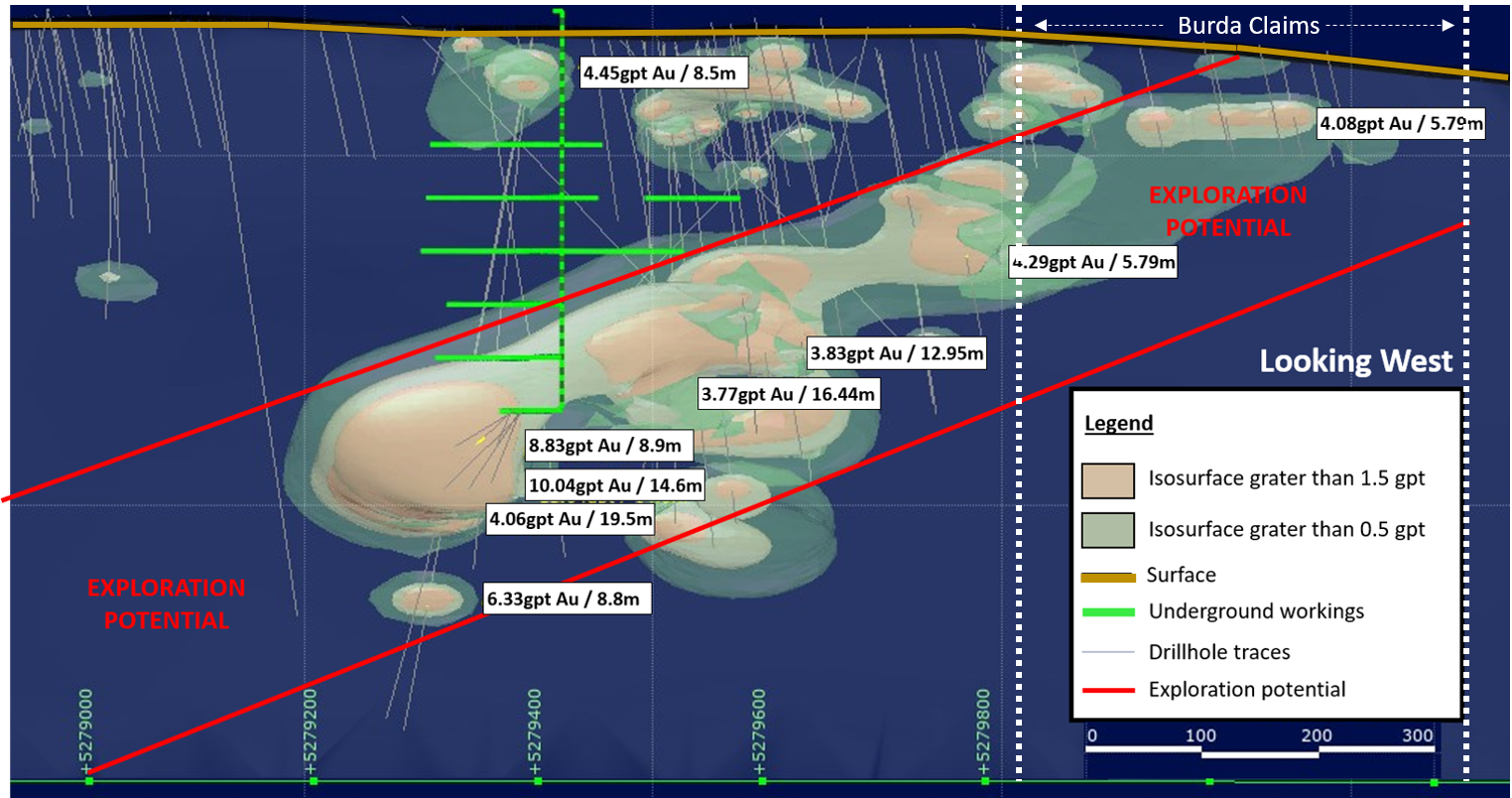

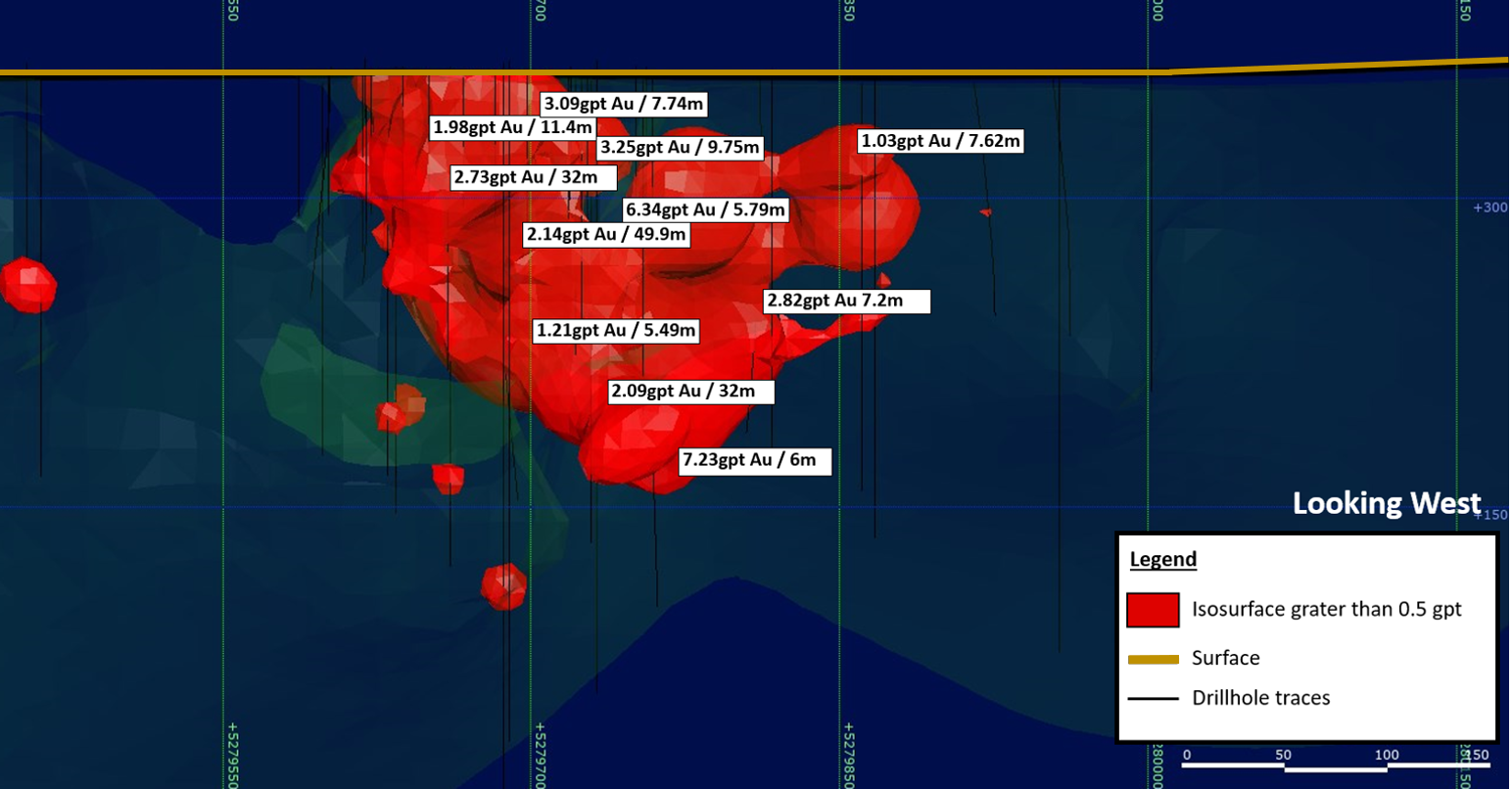

Duggan

Duggan is located 1.5 km west of Tyranite and hosts similar geology and potential for a high-grade open pit. Previous property owners confirmed historical work and expanded the mineral zone's strike extension to 700 metres and a depth of 410 metres.

Previous drilling on the property yielded near-surface intersections—notably:

- 2.14 g/t Au over 49.9 metres (1316-08)

- 2.73 g/t Au over 32 metres (1316-09)

- 7.23 g/t Au over 6 metres (CD13-03)

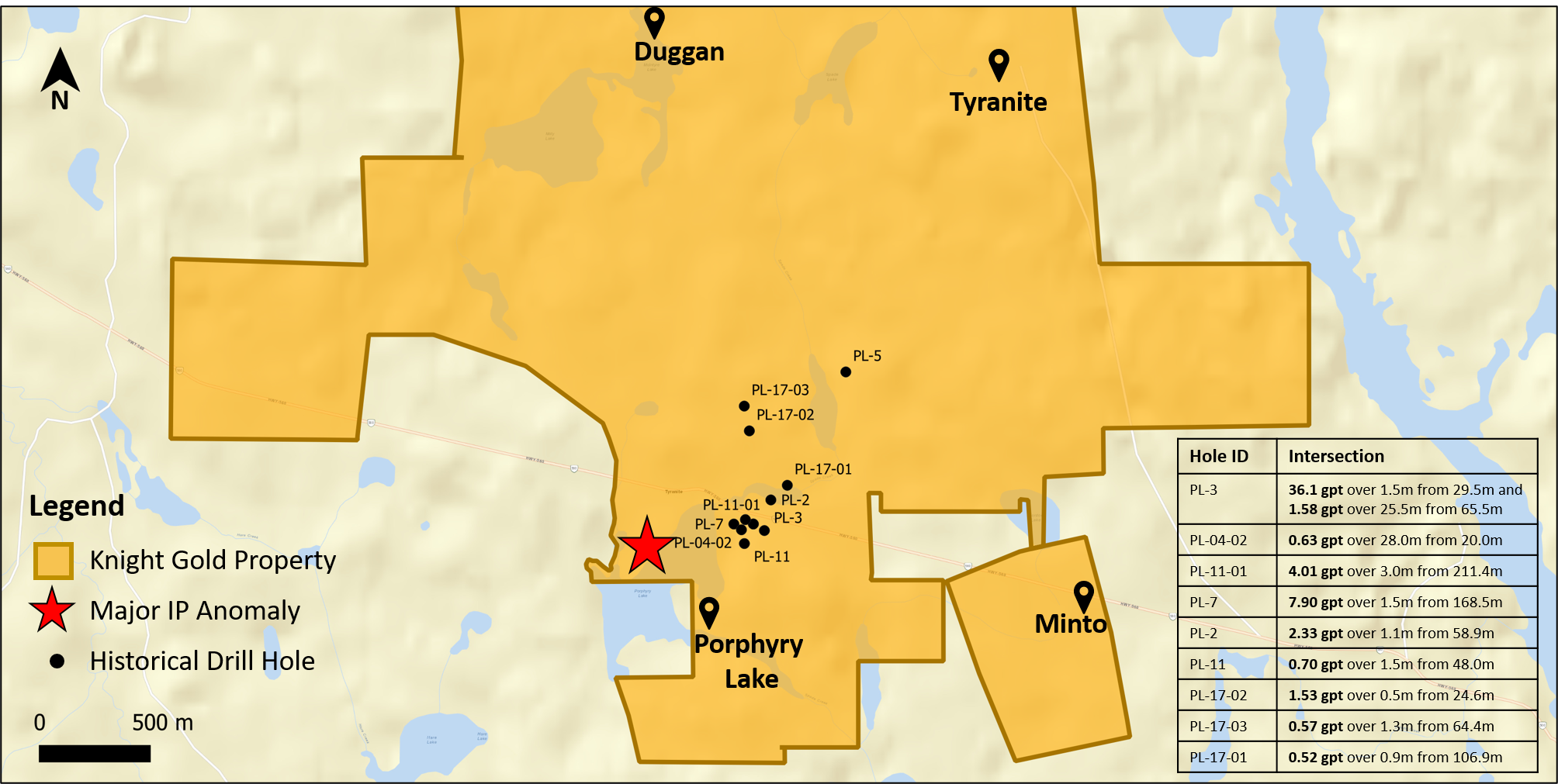

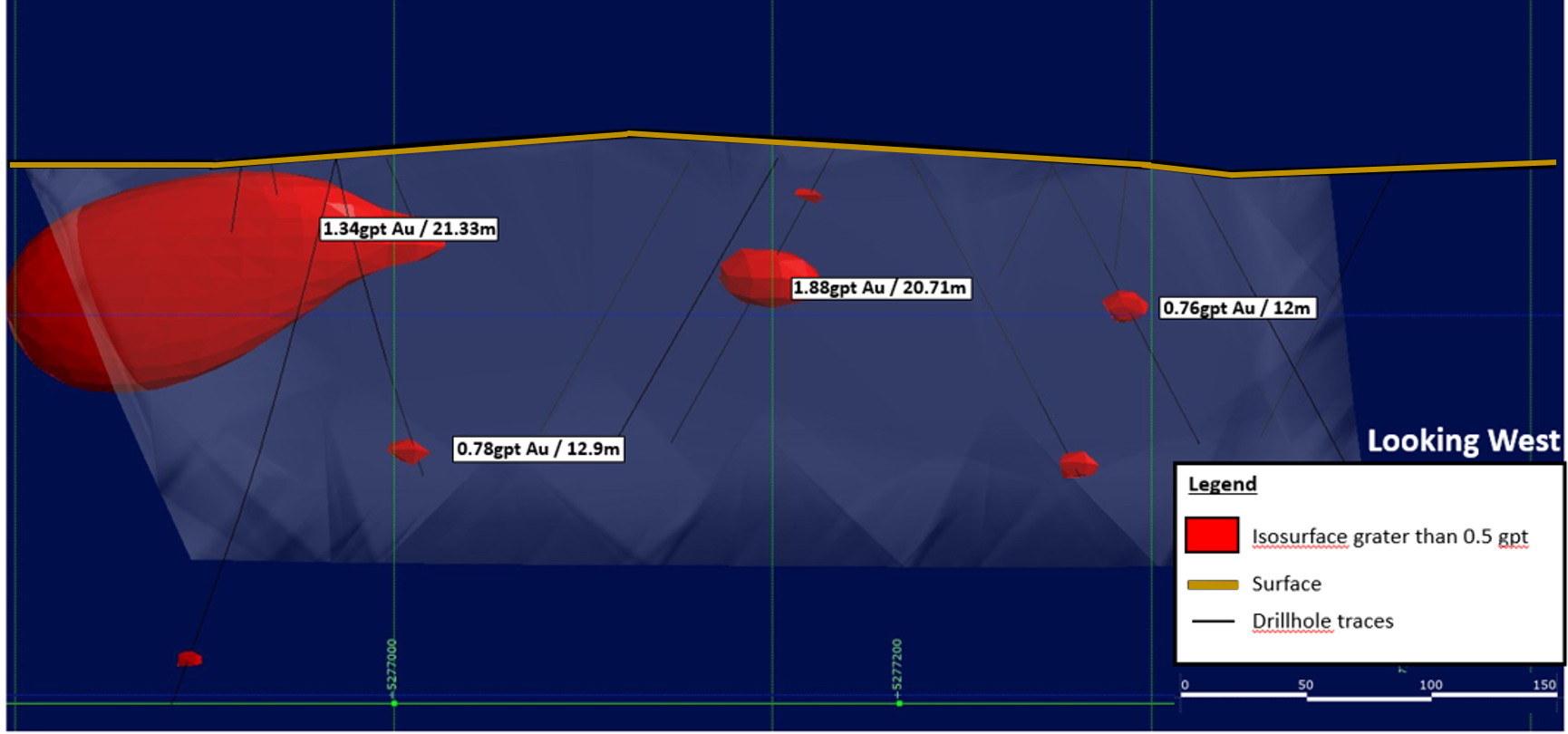

Porphyry Lake

Porphyry Lake hosts two gold mineralized porphyry systems with wide, low-grade gold intersections in drilling. Mineralization is consistent with a mineralized porphyry system. There is potential to eventually develop it into a large, bulk tonnage open pitable deposit. The property also potentially hosts breccia pipes similar to that at Minto, as it is located immediately to the west of Minto and contiguous to Tahoe's Juby north boundary.

Notable intersections include:

- 1.88 g/t Au over 20.7 metres (PL-3)

- 1.34 g/t Au over 21.3 metres (PL-04-02)

Exploration Plan

Tyranite

Historical exploration of Tyranite shows that grades are high enough to be economic. The project's key is to delineate sufficient economic grade mineralization within the mine infrastructure to justify rehabilitation of the shaft and renewed underground exploration.

Minto

In spite of seeing very high grades, including abundant visible gold, Minto's breccia requires additional work to increase tonnage and recoveries to boost its gold ounce per vertical metre. The proposed work program aims to confirm the mineralized breccia's width at depth (below 229 metres) beneath the diabase dyke.

ORECAP's reprocessed high-resolution magnetic data at Minto, using the Minto pipe as a reference. The new survey shows three dozen similar magnetic anomalies within the same formation that hosts Minto and Porphyry Lake systems. Furthermore, ORECAP conducted ground sampling on all three dozen targets and have confirmed ten targets for follow up IP surveying, given the Minto Breccia Pipe responds to the IP survey. Any anomalous targets from the IP survey will be drill tested. The discovery of new breccia pipes could significantly improve economics and increase the scale of Minto.

Duggan

The known mineralization at Duggan is rich and wide enough to consider an open pit that could significantly contribute to the overall project. The proposed work program calls for validation of historical drilling and a drill program to increase mineralization for a maiden resource and possibly a PEA.

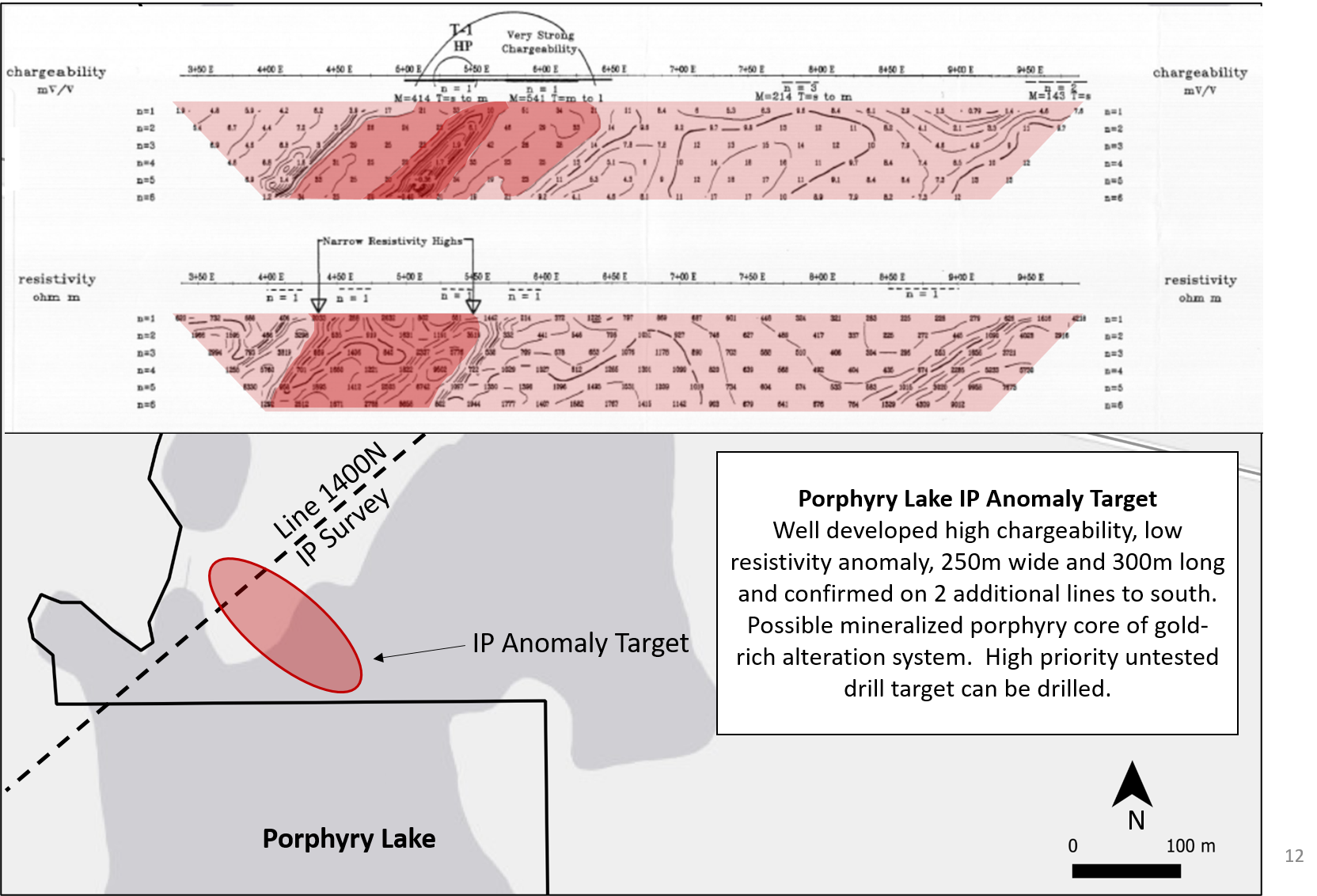

Porphyry Lake

Porphyry Lake's exploration plan revolves around two main objectives: 1) find a center of porphyry-type gold mineralization with open pit potential; and 2) find additional Minto-type breccia zones, which are small but very high grade.

ORECAP has identified a major, untested IP high chargeability/low resistivity anomaly over 300m long by 250m wide under Porphyry Lake. We believe that there is a large gold system centred on Porphyry Lake, which shows multiple significant intersections surrounding the large, untested IP target–which has never been previously drilled. ORECAP will focus on drilling this target.